Finance and Tax [2011] No. 87

Provinces, autonomous regions, municipalities directly under the Central Government, State Planning Department, Department of Finance (Bureau), State Administration of Taxation, People's Bank of China Shanghai Headquarters, branches, business management departments, capitals (capital) city center sub-branches, and sub-provincial city center sub-branches:

In order to promote the development of China's olefin chemical industry, with the approval of the State Council, the continuation of the tax reimbursement (exemption) taxation policy for naphtha and fuel oil used in the production of ethylene and aromatics chemical products is now clarified as follows:

1. From October 1st, 2011, the consumption tax on naphtha and fuel oil for the production of ethylene and aromatics chemical products will be resumed for enterprises that produce naphtha and fuel oil (hereinafter referred to as production enterprises). .

2. From October 1, 2011, production enterprises producing naphtha and fuel oil for the production of ethylene and aromatics chemical products will be temporarily exempted from consumption tax according to actual consumption.

3. As of October 1, 2011, naphtha and fuel oils purchased by companies that use ethylene naphtha and naphthas using naphtha and fuel oil (hereinafter referred to as “using companiesâ€) to produce ethylene and aromatics chemical products, According to the actual consumption amount, it shall be temporarily refunded of the consumption tax.

The formula for calculating the consumption tax for naphtha and fuel oil returned is:

The amount of consumption tax to be refunded = actual amount of naphtha and fuel oil consumed × unit tax for naphtha and fuel oil consumption tax.

The use of the place where the enterprise is located, the State Administration of Taxation (hereinafter referred to as the competent tax authority) shall be responsible for the tax refund. The competent taxation authority shall calculate the amount of taxable tax refund based on the actual consumption of naphtha and fuel oil used by the company, and issue an “income return book†(budget subject is refined oil consumption tax refund), followed by a tax refund approval form, tax refund application, etc. Hand in the local treasury department. After reviewing by the treasury department, taxes are withdrawn from the central budget revenue.

4. From January 1st to September 30th, 2011, naphtha and fuel oil sold by manufacturing enterprises to enterprises for use in the production of ethylene and aromatics chemical products are still subject to the “Examination of Refined Product Consumption Tax by the State Administration of Taxation of the Ministry of Financeâ€. Notice of Taxation on Related Product Oil Consumption Tax Policies (Cai Shui [2008] No. 168), Notice of the Ministry of Finance and State Administration of Taxation on Adjusting Some Fuel Oil Consumption Tax Policies (Cai Shui [2010] No. 66) and the State Administration of Taxation on Printing The "Notice on the Administration of Consumption Tax Exemption for Naphtha" (Guo Shui Fa [2008] No. 45) stipulates the exemption of consumption tax.

5. During the period from January 1st to September 30th, 2011, the consumption tax naphtha and fuel oil used for the production of ethylene and aromatics chemical products purchased by enterprises shall be refunded in accordance with Article 3 of this Notice. .

6. The competent tax authority shall carefully check and verify the inventory of companies purchasing naphtha and fuel oil from January 1 to September 30, 2011, and use it for the extirpation (exemption) of consumption tax that has consumed the inventory. Oil and fuel oil may not be refunded.

7. Before December 31, 2010, the tax on consumption of naphtha and fuel oil imported by the manufacturer itself or imported by entrusted agents shall be refunded. The relevant refined oil products are still subject to the State Administration of Taxation of the Ministry of Finance on increasing the consumption tax rate of refined oil products. Notice of Consumption Tax Policies (Caixi [2008] No. 168), “Notice of the Ministry of Finance and State Administration of Taxation on Adjusting Partial Fuel Oil Consumption Tax Policies†(Cai Shui [2010] No. 66), “Ministry of Finance, State Administration of Taxation, Adjustment of Refined Oil Imports Circular on Consumption Tax (Fiscal Tariff [2008] No. 103), Notice of the Ministry of Finance on Adjusting Part of the Import Fuel Oil Consumption Tax Policy (Finance Tariff [2010] No. 56), and Ministry of Finance, General Administration of Customs, State Administration of Taxation, Importation The notification of naphtha excise tax refund on the first issue (Caiqin [2009] No. 347) will continue to be refunded.

8. The production of ethylene and aromatics chemical products using naphtha and fuel oil accounts for more than 50% (including 50%) of the total production of naphtha and fuel oil used by the company and enjoys the benefits of this notice. (Exemption) Consumption tax policy. Enterprises complying with the conditions prescribed in this article shall, after the issuance of this notice, go to the competent tax authority to submit qualifications for tax refund (exemption).

Nine, ethylene chemical products refer to ethylene, propylene, butadiene and derivatives; aromatic chemical products refer to benzene, toluene, xylene, heavy aromatics, mixed aromatics and derivatives.

X. Use the taxable products for consumption tax produced during the production of ethylene and aromatics chemical products, and pay the consumption tax according to the regulations.

11. The specific tax refund (exemption) tax management measures for the consumption tax on naphtha and fuel oil used in the production of ethylene and aromatics chemical products shall be separately formulated by the State Administration of Taxation.

12. The Office of the Finance Ombudsman in various localities of the Ministry of Finance shall strengthen the supervision and inspection of the implementation of the consumption tax refund (exemption) policy. The national tax bureaus at all levels must strengthen the organization and supervision of tax refund (exemption) for consumption tax, strictly manage and plug loopholes. For the found and verified fraudulent withdrawal (exemption) of taxation, it shall be punished according to law, and the qualification for withdrawal (exemption) of consumption tax shall be abolished.

Ministry of Finance The State Administration of Taxation of the People's Bank of China

September 15, 2011

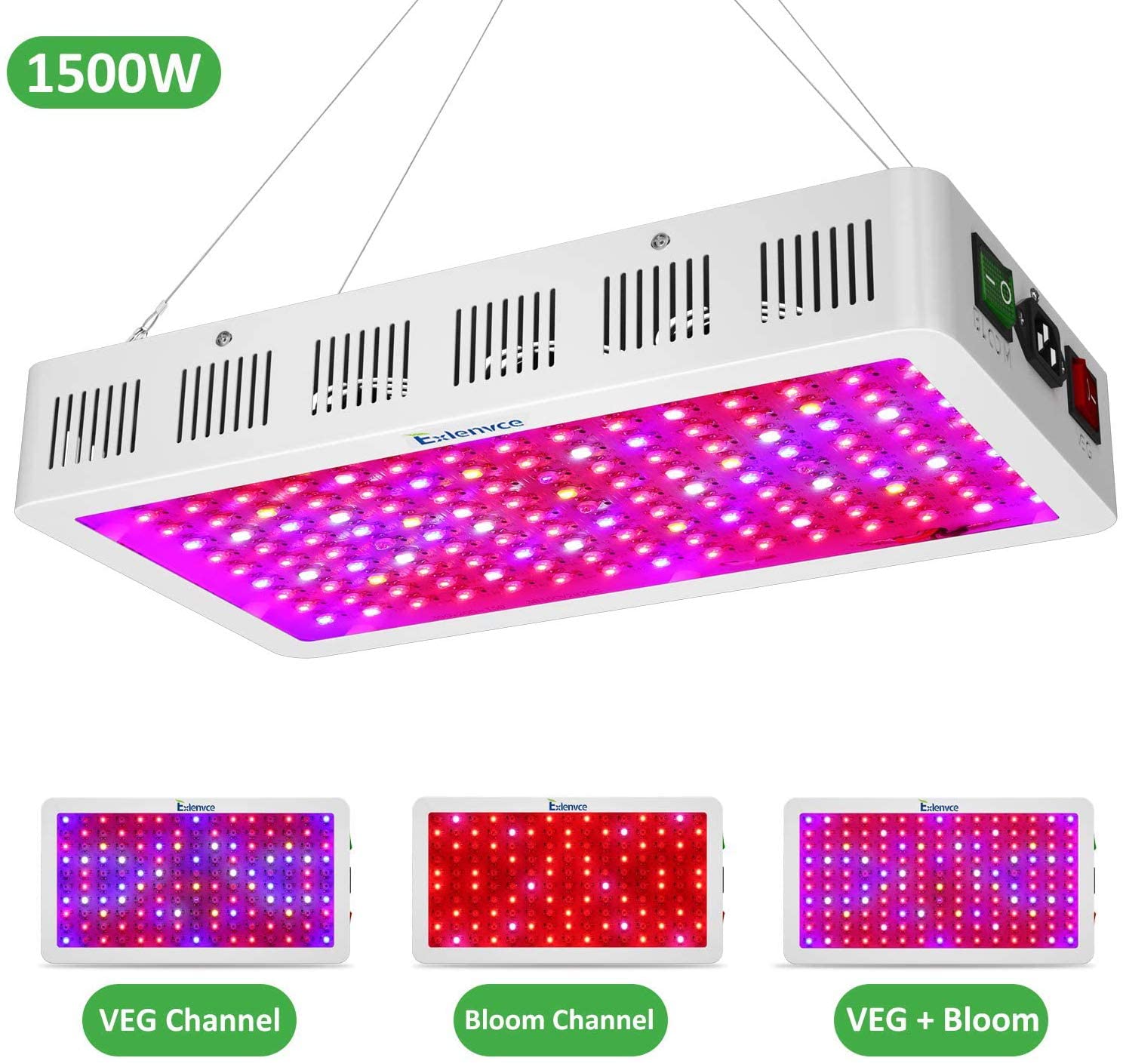

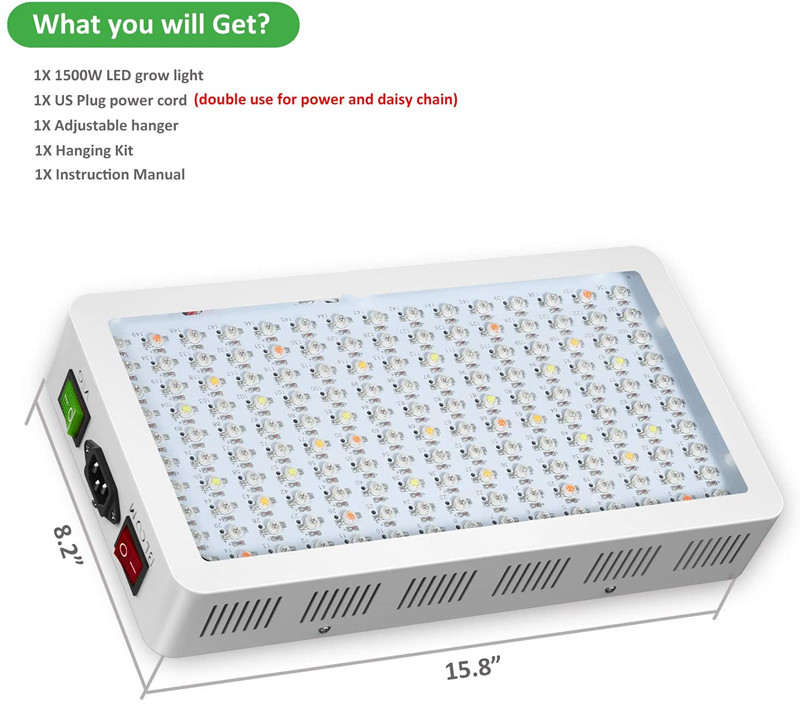

Full Spectrum Led Lights 1500w,with 150pcs Epi double chips led, 3pcs fast-speed cooling fans,hot sale grow lampon Amazon Ebay. we can make 4000k white lighting and red blue lighting, double switch available here.

Led Lights For Indoor Plants 1500w grow light is a great ideal for all kinds of indoor garden plants: lettuce, orchid, organic herbs, pepper, strawberries, succulent, hydroponic, medical plants.

Double switch photo:

Best Led Grow Lights,Diy Led Grow Light,Fluorescent Grow Lights,Uv Light For Plants

Shenzhen Wenyi Lighting Technology Co., Ltd , https://www.wenyigrow.com