Since the financial crisis broke out in Asia in the past few years, the machine tool market, which has maintained a steady growth momentum for a long time, is no longer in a good position, and the scale of production and sales is shrinking.

From the demand situation of machine tools, the world's machine tool consumption in 1998 was roughly 32.87 billion US dollars, a decrease of 2.5% compared with 1997. In 1999, the demand situation of the world machine tool market is currently not accurate. However, due to the 2/3 of the total demand in the world machine tool market, the United States, Germany, Italy, Japan, China and France spent only $22.73 billion in machine tool consumption in 1999. The previous year's decrease of 6.8% (of which the United States and Japan decreased by 18% and 22.7% respectively) is not expected to change significantly.

The direct consequence of the sluggish world machine tool market is that the scale of production of machine tool manufacturing worldwide has generally shrunk. According to statistics, the value of the world machine tool manufacturing industry in 1999 was 34.5 billion US dollars, a decrease of 6.5% over the previous year. This is the third consecutive year of shrinking the world's machine tool manufacturing production scale. Specifically, the production scale of Japan and the United States in the world's three major machine tool countries shrank the most, with output values ​​reduced by 14% and 19.4% respectively. The performance of the German machine tool manufacturing industry was mild, and the output value decreased by 1.3% from the previous year.

Due to the lag in the shrinking trade volume in the world machine tool market, the world's machine tool trade in terms of export volume in 1998 still reached 21.51 billion US dollars, still barely growing by 0.9%, while the world machine tool market in 1999 was finally out of the world. The internal delay has slowed the pace of development of machine tool trade. In this year, the world's machine tool trade volume by export volume contracted to 20.5 billion US dollars, shrinking by 4.7%, including Japan, Germany, Italy, Switzerland and the United States, the export value of machine tools decreased by 6.6%, 5.3%, 3.3%, 1.5. % and 12.1%, while the machine exports of these five countries account for about three-quarters of the world.

The impact of the Asian financial crisis on the world machine tool market cannot be avoided. The lag effect will not be completely eliminated in the short term, but it should also be noted that the downturn in the world machine tool market also has its inherent reasons. For example, in recent years, the Western industrialized countries led by the United States have overemphasized the leading role of certain emerging industries that have been included in the new economic category in economic development, resulting in certain industries dominated by traditional economic components in a certain period of time. Being left out. In another example, in recent years, although the machine tool manufacturing industry in the world has been improving at the technical level, the pace of technology upgrading has lagged behind that of emerging industries such as computers and semiconductors. Therefore, its market size is more dependent on existing Planar expansion at the technical level, rather than a three-dimensional expansion at a higher technical level.

Specifically, although the sluggishness of the world machine tool market has shown a certain degree of generality in recent years, the degree of sluggishness in the production and marketing areas of major machine tools is still different, so the performance in the recovery process will also be different.

Second, the status and analysis of several major markets

1. United States The United States is the largest machine tool market in the world today. The actual demand in 1999 was 7.11 billion US dollars, accounting for about 21% of the total global machine tool demand. From 1991 to 1998, the US machine tool market experienced eight consecutive years of prosperity, but the situation in 1999 has turned sharply. The demand for machine tools in the domestic market has shrunk by 18%, which reflects to some extent the US investor's tradition. Ignore the industry. At the same time, due to the lagging influence of the Asian financial crisis, after the growth of 10.3% in 1998, the value of machine tool exports in the United States in 1999 was significantly reduced to 1.3 billion US dollars, a reduction of 12.2%. It is not difficult to see that under the dual pressure of both domestic and foreign markets, the operation of the US machine tool manufacturing industry has become increasingly bleak. According to statistics, the output value of the US machine tool manufacturing industry in 1999 was only 4.35 billion US dollars, a decrease of 19.3% over the previous year.

At present, there are signs that the market environment of the US machine tool manufacturing industry has recovered. This is mainly because the bubble brewed by the new economy has begun to burst. American investors are rediscovering the business opportunities contained in traditional industries, and to a certain extent, Many orders have returned to the US machine tool manufacturing industry. At the same time, the development of emerging industries such as the aerospace industry has brought more new demands to the US machine tool manufacturing industry, and the recovery growth of the Asian economy will correspondingly make the US machine tool manufacturing industry. Increased opportunities for export.

2. Japan Japan's machine tool manufacturing industry ranks first in the world in terms of scale and has the highest market share in the international market. In recent years, the Japanese economy has not been very prosperous, and the Japanese domestic machine tool market has become even more bleak. According to statistics, the actual domestic demand for machine tools in 1999 was only 2.86 billion US dollars, a decrease of 22.7% over the previous year. Together with the decline of the previous year, the cumulative decline in the two years was about 30%. At the same time, Japan's machine tool exports have also been weak in recent years. In 1999, Japanese machine tool exports decreased by 6.6% on the basis of a 11% reduction in 1998. The main reason is that the demand in North America and Asia, which accounts for 70% of Japan's machine tool exports, has fallen sharply, and the pressure on foreign machine tools in Korea and Taiwan has become increasingly competitive. According to the Japan Machine Tool Industry Association, orders received by Japan's top ten machine tool manufacturers in 1999 were about 30% lower than the same period last year. The output value also decreased by about 14% on the basis of a decrease of nearly 10% in the previous year, only 7.72 billion US dollars.

In order to revive the Japanese machine tool manufacturing industry, the Japan Machine Tool Industry Association has developed a series of improvement measures some time ago, such as implementing low-cost and high-quality strategies to maintain market competitiveness, establish a new export order, and introduce a level of adaptation to the needs of developing countries. The company's products, shorten the circulation process, pay more attention to the research and development of high-performance CNC machine tools and increase investment in overseas. The effects of these measures will remain to be seen, but there are indications that the production and sales of Japanese machine tools are re-energizing. According to statistics, in the first half of 2000, the import value of Japanese machine tools reached 35 billion US dollars, an increase of 4.1% over the same period of the previous year. In the first 8 months, the Japanese machine tool manufacturing industry received orders of 624.2 billion US dollars, an increase of about 26% over the same period of the previous year. . It is not difficult to see that with the rebound of investment in related industrial equipment in Japan, the demand for machine tools, especially for EDM machines, laser machine tools, boring machines, special machine tools, and forging presses, will increase significantly in the Japanese market.

3. Germany Germany is also a major machine tool producer in the world today. The output value of the machine tool manufacturing industry ranks second in the world after the United States. In 1998, the value of the German machine tool manufacturing industry was 15.9 billion marks, an increase of about 13% over the previous year. In 1999, it increased by 5%. (Because the euro has been weak, the output value of the German machine tool manufacturing industry was converted into US dollars in 1999. To reduce by 1.3%). Although the demand for machine tools in the world is more severe, the impact on Germany is relatively mild due to the further strengthening of mutual demand among EU countries. According to statistics, the demand for machine tools in Germany in 1999 was 5.87 billion US dollars, still up 5.3% over the previous year, but the increase was significantly less than 22.3% in the previous year; although exports fell 5.1%, the decline was also significantly lower than Japan. Machine tools producing countries outside the EU, such as the United States, and if the factor of depreciation of the euro is removed, the export value of German machine tools calculated by Mark in 1999 was basically the same as that of the previous year.

In order to speed up the process of internationalization and to expand the market, in recent years, the German machine tool manufacturing industry has increased investment in Southeast Asia and Eastern Europe, and established new production and sales outlets through joint ventures and mergers and acquisitions, and compressed the German machine tool manufacturing industry. Production costs and improved financial conditions are very beneficial. At the same time, through continuous research and development of new technologies, the German machine tool manufacturing industry has also created more marketing hotspots in the market, such as multi-purpose integrated processing machines with freely convertible spindle positions and automatic tool exchange, and humanized design features. Flexible manufacturing unit, etc. In general, the machine tool market in Germany is now hotter than in the rest of the world.

According to the predictions of relevant authorities, from 2000 to 2002, the scale of demand expansion of the German machine tool market can be maintained at roughly 5% to 10%, and the market size of flexible manufacturing units can reach 10% per year. 15%.

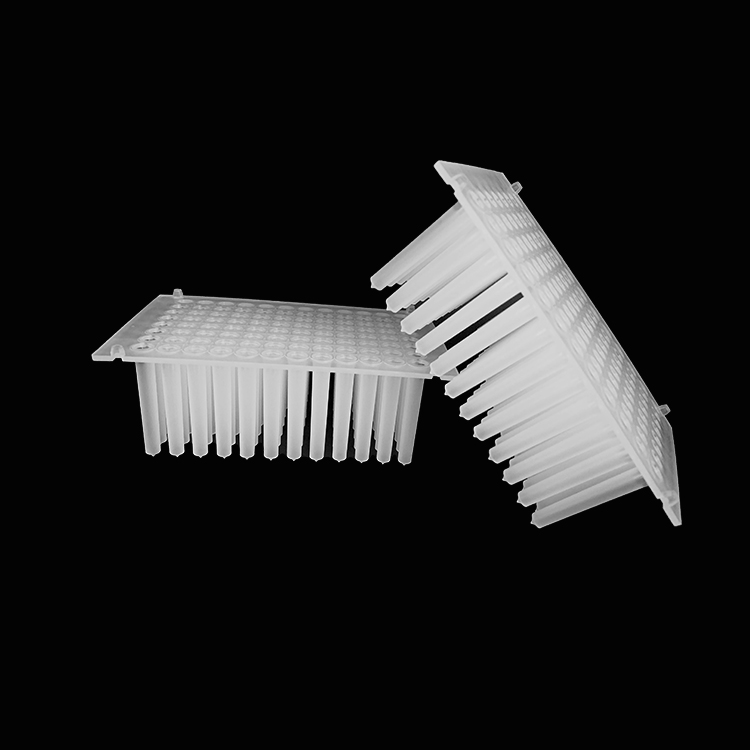

These tip combs are for use with the Pharma KingFisher Flex 96 Deep-Well Head Magnetic Particle Processor or MagMAX Express-96 Deep-Well Magnetic Particle Processor in combination with PrepSEQ ResDNA kits and ProteinSEQ kits.

Optimize performance using KingFisher Flex System consumables designed specifically for use with these instruments. KingFisher Flex disposable plastics (tip combs and microplates) are made of polypropylene and are ideal for magnetic particle processing because of their low binding affinity for biomolecules. Their special design enables excellent recovery of magnetic beads.

The tip combs are made of PP material, they can be used with 2.2ml square well V bottom and 0.5ml elution plates for the system KINGFISHER FLEX. The tip combs could suffer centrifuge 3000-4000 and don't change the original shape. The products are suitable for the standard ANSI and multi-channel Pipette Tips machnie and automatic equipment. We could accept OEM/ODM.

For use with Viral RNA extraction, DNA extraction, RNA/DNA quantification, immunopreciptitations and many more KingFisherâ„¢ applications

good chemical and physical resistance: e.g. phenols, chloroform, DMSO and temperatures as low as -80°C/-112°F

Tip Comb,Tip Comb Plate,Kingfisher Tip Comb,Tip Comb Kingfisher,Magnetic Tip Comb,8-Strip Tip Comb

Yong Yue Medical Technology(Kunshan) Co.,Ltd , https://www.yonyue-pcrtube.com