Recently, the China Small and Medium Enterprises Association announced the China SME Development Index for the fourth quarter of 2011: the China SME Development Index (SMEDI) for the fourth quarter of 2011 was 93.5, down 3.7 points from the third quarter. Under the macroeconomic situation in which China's economic growth rate has gradually declined, the development of the SMEs in a weak position in the market economy has not changed fundamentally compared with the previous quarter.  1. All the industry indices fell below the threshold of 100 for the first time. From the eight sub-sectors surveyed, the first time all fell below the threshold of 100, including the wholesale and retail index of 95.2, down 3.3 points; information transmission computer service software The industry was 95.0 points, down 2.7 points; the accommodation and catering industry was 91.0, down 1.8 points; the social service industry was 98.3, down 4.5 points. (1) Decrease in industrial index quarter by quarter The industrial index in the fourth quarter was 92.9, down 3.6 points from the previous quarter. Since the industrial index fell below the 100-point threshold of 100 points in the second quarter, the decline has increased quarter by quarter. Among the industrial enterprises surveyed, 74.3% of enterprises' orders, 72.6% of the company's total production, 73.2% of the company's sales volume and 70.7% of the company's average product sales prices were all down or flat compared with the same period of the previous year. Among export-oriented foreign trade production enterprises, 85% of foreign companies' orders were reduced or flat compared with the same period of the previous year. Among the eight sub-indices of the industry, the cost index rose by a large margin, rising by 12.9 points, indicating that the cost pressure of industrial enterprises has eased, but the cost index is still very low, only 75.4. The cost pressure of industrial enterprises has eased, mainly due to the decrease in production costs, raw material purchase prices and labor costs. According to the survey, 20% of enterprises responded to production costs and labor costs, and 33% of enterprises' feedback on raw material purchase prices fell or remained flat compared with the same period of the previous year. Although the ratio of these two items is not high, it is slightly higher than the previous quarter.

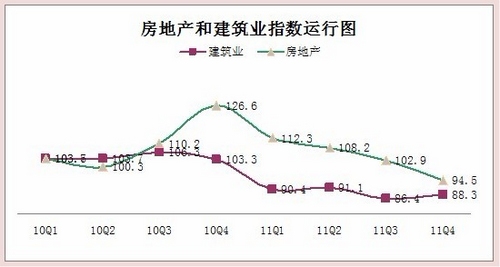

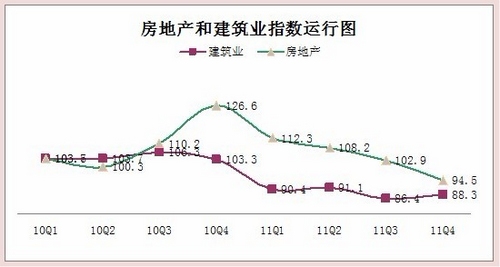

1. All the industry indices fell below the threshold of 100 for the first time. From the eight sub-sectors surveyed, the first time all fell below the threshold of 100, including the wholesale and retail index of 95.2, down 3.3 points; information transmission computer service software The industry was 95.0 points, down 2.7 points; the accommodation and catering industry was 91.0, down 1.8 points; the social service industry was 98.3, down 4.5 points. (1) Decrease in industrial index quarter by quarter The industrial index in the fourth quarter was 92.9, down 3.6 points from the previous quarter. Since the industrial index fell below the 100-point threshold of 100 points in the second quarter, the decline has increased quarter by quarter. Among the industrial enterprises surveyed, 74.3% of enterprises' orders, 72.6% of the company's total production, 73.2% of the company's sales volume and 70.7% of the company's average product sales prices were all down or flat compared with the same period of the previous year. Among export-oriented foreign trade production enterprises, 85% of foreign companies' orders were reduced or flat compared with the same period of the previous year. Among the eight sub-indices of the industry, the cost index rose by a large margin, rising by 12.9 points, indicating that the cost pressure of industrial enterprises has eased, but the cost index is still very low, only 75.4. The cost pressure of industrial enterprises has eased, mainly due to the decrease in production costs, raw material purchase prices and labor costs. According to the survey, 20% of enterprises responded to production costs and labor costs, and 33% of enterprises' feedback on raw material purchase prices fell or remained flat compared with the same period of the previous year. Although the ratio of these two items is not high, it is slightly higher than the previous quarter.  (2) The transportation postal warehousing industry index was at a low level. The transportation postal warehousing industry index was 88.6 in the fourth quarter, which was the lowest among the eight sub-sectors, down 5.8 points from the previous quarter. According to the survey, 78.8% of corporate business bookings and 76.5% of corporate business volume were reduced or flat compared with the same period of the previous year, and 74% of corporate business charges were lower or flat than the same period of the previous year. Transportation The postal warehousing industry belongs to the logistics industry and often has the role of foreboding. The continuous decline of its sub-industry index is worthy of attention. (3) The real estate industry index fell the most. The real estate index in the fourth quarter was 94.5. It fell below the threshold of 100 for the first time, down 8.4 points from the previous quarter, and the decline was more than the other seven sub-sectors. The real estate industry index reached 126.6 points in the fourth quarter of 2010, and it declined quarter by quarter, with the largest decline. From the perspective of this quarter, it was mainly due to the significant decline in the sales area, sales price and new construction area of ​​commercial housing. According to the survey, 80.8% of the pre-sale area of ​​commercial housing, 78.4% of the new construction area, 87.2% of the commercial housing sales area, and 70.4% of the average sales price of commercial housing were all lower than the same period of the previous year.

(2) The transportation postal warehousing industry index was at a low level. The transportation postal warehousing industry index was 88.6 in the fourth quarter, which was the lowest among the eight sub-sectors, down 5.8 points from the previous quarter. According to the survey, 78.8% of corporate business bookings and 76.5% of corporate business volume were reduced or flat compared with the same period of the previous year, and 74% of corporate business charges were lower or flat than the same period of the previous year. Transportation The postal warehousing industry belongs to the logistics industry and often has the role of foreboding. The continuous decline of its sub-industry index is worthy of attention. (3) The real estate industry index fell the most. The real estate index in the fourth quarter was 94.5. It fell below the threshold of 100 for the first time, down 8.4 points from the previous quarter, and the decline was more than the other seven sub-sectors. The real estate industry index reached 126.6 points in the fourth quarter of 2010, and it declined quarter by quarter, with the largest decline. From the perspective of this quarter, it was mainly due to the significant decline in the sales area, sales price and new construction area of ​​commercial housing. According to the survey, 80.8% of the pre-sale area of ​​commercial housing, 78.4% of the new construction area, 87.2% of the commercial housing sales area, and 70.4% of the average sales price of commercial housing were all lower than the same period of the previous year.  (4) The lowest construction industry index for the construction industry index was 88.3. Although it rose by 1.9 points, it was the lowest among the eight sub-industry indices. Judging from the details of the survey, the number of newly signed engineering contracts and enterprise project settlement income is relatively poor. The overall efficiency of construction enterprises is not good, only 18.3% of the company's feedback has increased or reduced losses compared with the same period last year. 2. The sub-index that fell below the threshold of 100% of the boom has increased. Among the eight sub-indices, except for the comprehensive business index, labor index, and input index, they are all below the threshold of 100. The comprehensive business index was 103.0, down 5.7 points. (1) The macroeconomic experience index and the market index fell the most. The macroeconomic experience index in the fourth quarter was 96.7, which was a large drop in the sub-index, down 7.2 points. From the survey details, the surveyed companies are not optimistic about macroeconomic expectations, especially for the industrial, transportation postal warehousing, real estate and information transmission computer service software industry; the surveyed enterprises are in the industry, especially the transportation postal warehousing The industry, the real estate industry, and the information transmission computer service software industry are not confident enough. Enterprises in the wholesale and retail industry and the accommodation and catering industry are more confident in the operation of the industry. In the fourth quarter, the market index was 96.4, which was the largest drop in the sub-index, down 7.8 points. According to a survey of eight sub-industries, 74% of the company's product orders, 73% of the company's total production, and 75% of the company's product sales decreased or remained the same as the same period of the previous year. Among export-oriented enterprises, 71% of foreign companies' orders were reduced or flat compared with the same period of the previous year. In general, it is necessary to boost the expectations of enterprises on the macro economy and the market. (2) The downward trend of cost and capital index continued to slow down and even improved. The cost index in the fourth quarter was 80.5, which was the only increase among the eight sub-indices, with an increase of 11.3 points. From the perspective of the sub-sectors, the cost index of the wholesale and retail industry and the information transmission computer service software industry continued to decline, indicating that the cost pressure of enterprises is still increasing. The cost index of other industries has risen, and the largest increase is in the real estate industry. According to the survey details, 63% of the purchase price of raw materials and energy of the enterprise increased compared with the same period of the previous year, which was 10 percentage points lower than that of the previous quarter; 75% of the enterprise labor cost increased, which was 3 percentage points lower than the previous quarter. In general, the state's policy measures to regulate prices are conducive to the decline of corporate costs, and the cost pressure has been alleviated to some extent. The fund index for the fourth quarter was 86.8, which was basically the same as last quarter and only dropped by 0.5 points. From the survey details, the liquidity index was 80.4, down 4.8 points from the previous quarter, and 10% of the surveyed companies reported sufficient liquidity, which was 3 percentage points lower than the previous quarter. The financing index was 72.5, up 2.6 points from the previous quarter. 4% of the surveyed companies were easy to provide financing, which was slightly higher than the previous quarter. The state has fine-tuned its financing policies and strived to improve the flexibility, pertinence, and forward-looking policies of the policies. (3) The company's efficiency is still poor The benefit index in the fourth quarter was 77.2, which was larger than that of the previous quarter, down 4.1 points. In terms of sub-sectors, the largest decline in the benefit index was in the real estate industry and the information transmission computer service software industry, which fell by 9.2 and 9.8 points respectively. Only the wholesale and retail industry and the construction industry benefit index rose by 2.9 and 1.3 points respectively. According to the survey, 48% of enterprises increased their losses or reduced their profits, an increase of 3 percentage points from the previous quarter. (4) The highest input index The investment index for the fourth quarter was 107.0, which was the highest among the eight sub-indices, down 2.3 points. From the industry point of view, the five major industries of accommodation and catering, social services, industry, wholesale and retail, transportation and postal warehousing are above the threshold of the economy. Compared with the previous quarter, the construction industry, wholesale and retail trade and transportation postal warehousing industry The input index has risen to varying degrees. In the survey's detailed items, industrial enterprises' investment in science and technology innovation has increased, and investment in fixed assets has declined. The company's investment in upgrading and technological innovation is focused on the future development, showing that it is optimistic about the future. (5) The labor force index is higher but the decline is larger. The labor force index in the fourth quarter was 105.3 points, a decrease of 6.3 points, a large decline. From the survey details, the labor demand is relatively strong. Except for the real estate industry, the other seven sub-industry indices are above 100, of which the industrial, social service, accommodation and catering industry and information transmission computer service software industry is up to 115 points; Insufficient labor supply, except for transportation postal warehousing, real estate, wholesale and retail, several other sub-sectors are below 100 points, of which accommodation and catering industry is only 71.7 points. The shortage of labor supply is especially for skilled workers. The highest supply index for skilled workers is no more than 90 points, and the transportation postal warehousing and accommodation catering industry is only 64.7 points and 65.7 points. The supply of college graduates is quite abundant. Except for the accommodation and catering industry, which is 98.6 points, the others are above 113 points, and the real estate industry and wholesale and retail industry are as high as 137.6 points and 133.3 points. 3. The central and western indices continued to be higher than the eastern fourth quarter. The eastern, central and western indices were 90.3, 97.2, and 103.5, respectively, down 4.8, 2.3, and 0.8 points from the previous quarter. From the regional index, the western region is better than the central region, and the central region is better than the eastern region. There are problems with the time lag and the hysteresis effect of macroeconomic regulation. Enterprises' expectations for the future are very important. From the macroeconomic perception index in the sub-indices, the declines in the eastern, central and western regions were 5.1, 11.5 and 12.8 respectively. For the future economic development, the confidence of the eastern enterprises began to increase. Industry is an important part of the real economy. From the perspective of industries in different industries, the declines in the eastern, central and western regions are 1.7, 7.6, and 1.6 points respectively. The enterprises in the central region have lower expectations for the future industrial climate than the eastern region. It will be further passed to the west. According to the survey, the real estate industry will continue to decline in the first quarter of 2012, and the decline will increase, which will further affect the construction industry. At the same time, the market index will continue to decline, and the SME development index will rebound. Not big. In the new year, issues such as the difficulty of financing in the development of small and medium-sized enterprises, rapid increase in production costs, increasing operational pressures, heavy tax burdens, and increased resource and environmental constraints should focus on small and micro enterprises. We will adopt various policy measures to boost corporate confidence and work hard to solve problems. Prevent local problems of small and medium-sized enterprises from becoming a global problem, and the problem of emergence becomes a trend problem, affecting the overall situation of China's social stability and economic development.

(4) The lowest construction industry index for the construction industry index was 88.3. Although it rose by 1.9 points, it was the lowest among the eight sub-industry indices. Judging from the details of the survey, the number of newly signed engineering contracts and enterprise project settlement income is relatively poor. The overall efficiency of construction enterprises is not good, only 18.3% of the company's feedback has increased or reduced losses compared with the same period last year. 2. The sub-index that fell below the threshold of 100% of the boom has increased. Among the eight sub-indices, except for the comprehensive business index, labor index, and input index, they are all below the threshold of 100. The comprehensive business index was 103.0, down 5.7 points. (1) The macroeconomic experience index and the market index fell the most. The macroeconomic experience index in the fourth quarter was 96.7, which was a large drop in the sub-index, down 7.2 points. From the survey details, the surveyed companies are not optimistic about macroeconomic expectations, especially for the industrial, transportation postal warehousing, real estate and information transmission computer service software industry; the surveyed enterprises are in the industry, especially the transportation postal warehousing The industry, the real estate industry, and the information transmission computer service software industry are not confident enough. Enterprises in the wholesale and retail industry and the accommodation and catering industry are more confident in the operation of the industry. In the fourth quarter, the market index was 96.4, which was the largest drop in the sub-index, down 7.8 points. According to a survey of eight sub-industries, 74% of the company's product orders, 73% of the company's total production, and 75% of the company's product sales decreased or remained the same as the same period of the previous year. Among export-oriented enterprises, 71% of foreign companies' orders were reduced or flat compared with the same period of the previous year. In general, it is necessary to boost the expectations of enterprises on the macro economy and the market. (2) The downward trend of cost and capital index continued to slow down and even improved. The cost index in the fourth quarter was 80.5, which was the only increase among the eight sub-indices, with an increase of 11.3 points. From the perspective of the sub-sectors, the cost index of the wholesale and retail industry and the information transmission computer service software industry continued to decline, indicating that the cost pressure of enterprises is still increasing. The cost index of other industries has risen, and the largest increase is in the real estate industry. According to the survey details, 63% of the purchase price of raw materials and energy of the enterprise increased compared with the same period of the previous year, which was 10 percentage points lower than that of the previous quarter; 75% of the enterprise labor cost increased, which was 3 percentage points lower than the previous quarter. In general, the state's policy measures to regulate prices are conducive to the decline of corporate costs, and the cost pressure has been alleviated to some extent. The fund index for the fourth quarter was 86.8, which was basically the same as last quarter and only dropped by 0.5 points. From the survey details, the liquidity index was 80.4, down 4.8 points from the previous quarter, and 10% of the surveyed companies reported sufficient liquidity, which was 3 percentage points lower than the previous quarter. The financing index was 72.5, up 2.6 points from the previous quarter. 4% of the surveyed companies were easy to provide financing, which was slightly higher than the previous quarter. The state has fine-tuned its financing policies and strived to improve the flexibility, pertinence, and forward-looking policies of the policies. (3) The company's efficiency is still poor The benefit index in the fourth quarter was 77.2, which was larger than that of the previous quarter, down 4.1 points. In terms of sub-sectors, the largest decline in the benefit index was in the real estate industry and the information transmission computer service software industry, which fell by 9.2 and 9.8 points respectively. Only the wholesale and retail industry and the construction industry benefit index rose by 2.9 and 1.3 points respectively. According to the survey, 48% of enterprises increased their losses or reduced their profits, an increase of 3 percentage points from the previous quarter. (4) The highest input index The investment index for the fourth quarter was 107.0, which was the highest among the eight sub-indices, down 2.3 points. From the industry point of view, the five major industries of accommodation and catering, social services, industry, wholesale and retail, transportation and postal warehousing are above the threshold of the economy. Compared with the previous quarter, the construction industry, wholesale and retail trade and transportation postal warehousing industry The input index has risen to varying degrees. In the survey's detailed items, industrial enterprises' investment in science and technology innovation has increased, and investment in fixed assets has declined. The company's investment in upgrading and technological innovation is focused on the future development, showing that it is optimistic about the future. (5) The labor force index is higher but the decline is larger. The labor force index in the fourth quarter was 105.3 points, a decrease of 6.3 points, a large decline. From the survey details, the labor demand is relatively strong. Except for the real estate industry, the other seven sub-industry indices are above 100, of which the industrial, social service, accommodation and catering industry and information transmission computer service software industry is up to 115 points; Insufficient labor supply, except for transportation postal warehousing, real estate, wholesale and retail, several other sub-sectors are below 100 points, of which accommodation and catering industry is only 71.7 points. The shortage of labor supply is especially for skilled workers. The highest supply index for skilled workers is no more than 90 points, and the transportation postal warehousing and accommodation catering industry is only 64.7 points and 65.7 points. The supply of college graduates is quite abundant. Except for the accommodation and catering industry, which is 98.6 points, the others are above 113 points, and the real estate industry and wholesale and retail industry are as high as 137.6 points and 133.3 points. 3. The central and western indices continued to be higher than the eastern fourth quarter. The eastern, central and western indices were 90.3, 97.2, and 103.5, respectively, down 4.8, 2.3, and 0.8 points from the previous quarter. From the regional index, the western region is better than the central region, and the central region is better than the eastern region. There are problems with the time lag and the hysteresis effect of macroeconomic regulation. Enterprises' expectations for the future are very important. From the macroeconomic perception index in the sub-indices, the declines in the eastern, central and western regions were 5.1, 11.5 and 12.8 respectively. For the future economic development, the confidence of the eastern enterprises began to increase. Industry is an important part of the real economy. From the perspective of industries in different industries, the declines in the eastern, central and western regions are 1.7, 7.6, and 1.6 points respectively. The enterprises in the central region have lower expectations for the future industrial climate than the eastern region. It will be further passed to the west. According to the survey, the real estate industry will continue to decline in the first quarter of 2012, and the decline will increase, which will further affect the construction industry. At the same time, the market index will continue to decline, and the SME development index will rebound. Not big. In the new year, issues such as the difficulty of financing in the development of small and medium-sized enterprises, rapid increase in production costs, increasing operational pressures, heavy tax burdens, and increased resource and environmental constraints should focus on small and micro enterprises. We will adopt various policy measures to boost corporate confidence and work hard to solve problems. Prevent local problems of small and medium-sized enterprises from becoming a global problem, and the problem of emergence becomes a trend problem, affecting the overall situation of China's social stability and economic development.

1. All the industry indices fell below the threshold of 100 for the first time. From the eight sub-sectors surveyed, the first time all fell below the threshold of 100, including the wholesale and retail index of 95.2, down 3.3 points; information transmission computer service software The industry was 95.0 points, down 2.7 points; the accommodation and catering industry was 91.0, down 1.8 points; the social service industry was 98.3, down 4.5 points. (1) Decrease in industrial index quarter by quarter The industrial index in the fourth quarter was 92.9, down 3.6 points from the previous quarter. Since the industrial index fell below the 100-point threshold of 100 points in the second quarter, the decline has increased quarter by quarter. Among the industrial enterprises surveyed, 74.3% of enterprises' orders, 72.6% of the company's total production, 73.2% of the company's sales volume and 70.7% of the company's average product sales prices were all down or flat compared with the same period of the previous year. Among export-oriented foreign trade production enterprises, 85% of foreign companies' orders were reduced or flat compared with the same period of the previous year. Among the eight sub-indices of the industry, the cost index rose by a large margin, rising by 12.9 points, indicating that the cost pressure of industrial enterprises has eased, but the cost index is still very low, only 75.4. The cost pressure of industrial enterprises has eased, mainly due to the decrease in production costs, raw material purchase prices and labor costs. According to the survey, 20% of enterprises responded to production costs and labor costs, and 33% of enterprises' feedback on raw material purchase prices fell or remained flat compared with the same period of the previous year. Although the ratio of these two items is not high, it is slightly higher than the previous quarter.

1. All the industry indices fell below the threshold of 100 for the first time. From the eight sub-sectors surveyed, the first time all fell below the threshold of 100, including the wholesale and retail index of 95.2, down 3.3 points; information transmission computer service software The industry was 95.0 points, down 2.7 points; the accommodation and catering industry was 91.0, down 1.8 points; the social service industry was 98.3, down 4.5 points. (1) Decrease in industrial index quarter by quarter The industrial index in the fourth quarter was 92.9, down 3.6 points from the previous quarter. Since the industrial index fell below the 100-point threshold of 100 points in the second quarter, the decline has increased quarter by quarter. Among the industrial enterprises surveyed, 74.3% of enterprises' orders, 72.6% of the company's total production, 73.2% of the company's sales volume and 70.7% of the company's average product sales prices were all down or flat compared with the same period of the previous year. Among export-oriented foreign trade production enterprises, 85% of foreign companies' orders were reduced or flat compared with the same period of the previous year. Among the eight sub-indices of the industry, the cost index rose by a large margin, rising by 12.9 points, indicating that the cost pressure of industrial enterprises has eased, but the cost index is still very low, only 75.4. The cost pressure of industrial enterprises has eased, mainly due to the decrease in production costs, raw material purchase prices and labor costs. According to the survey, 20% of enterprises responded to production costs and labor costs, and 33% of enterprises' feedback on raw material purchase prices fell or remained flat compared with the same period of the previous year. Although the ratio of these two items is not high, it is slightly higher than the previous quarter.  (2) The transportation postal warehousing industry index was at a low level. The transportation postal warehousing industry index was 88.6 in the fourth quarter, which was the lowest among the eight sub-sectors, down 5.8 points from the previous quarter. According to the survey, 78.8% of corporate business bookings and 76.5% of corporate business volume were reduced or flat compared with the same period of the previous year, and 74% of corporate business charges were lower or flat than the same period of the previous year. Transportation The postal warehousing industry belongs to the logistics industry and often has the role of foreboding. The continuous decline of its sub-industry index is worthy of attention. (3) The real estate industry index fell the most. The real estate index in the fourth quarter was 94.5. It fell below the threshold of 100 for the first time, down 8.4 points from the previous quarter, and the decline was more than the other seven sub-sectors. The real estate industry index reached 126.6 points in the fourth quarter of 2010, and it declined quarter by quarter, with the largest decline. From the perspective of this quarter, it was mainly due to the significant decline in the sales area, sales price and new construction area of ​​commercial housing. According to the survey, 80.8% of the pre-sale area of ​​commercial housing, 78.4% of the new construction area, 87.2% of the commercial housing sales area, and 70.4% of the average sales price of commercial housing were all lower than the same period of the previous year.

(2) The transportation postal warehousing industry index was at a low level. The transportation postal warehousing industry index was 88.6 in the fourth quarter, which was the lowest among the eight sub-sectors, down 5.8 points from the previous quarter. According to the survey, 78.8% of corporate business bookings and 76.5% of corporate business volume were reduced or flat compared with the same period of the previous year, and 74% of corporate business charges were lower or flat than the same period of the previous year. Transportation The postal warehousing industry belongs to the logistics industry and often has the role of foreboding. The continuous decline of its sub-industry index is worthy of attention. (3) The real estate industry index fell the most. The real estate index in the fourth quarter was 94.5. It fell below the threshold of 100 for the first time, down 8.4 points from the previous quarter, and the decline was more than the other seven sub-sectors. The real estate industry index reached 126.6 points in the fourth quarter of 2010, and it declined quarter by quarter, with the largest decline. From the perspective of this quarter, it was mainly due to the significant decline in the sales area, sales price and new construction area of ​​commercial housing. According to the survey, 80.8% of the pre-sale area of ​​commercial housing, 78.4% of the new construction area, 87.2% of the commercial housing sales area, and 70.4% of the average sales price of commercial housing were all lower than the same period of the previous year.  (4) The lowest construction industry index for the construction industry index was 88.3. Although it rose by 1.9 points, it was the lowest among the eight sub-industry indices. Judging from the details of the survey, the number of newly signed engineering contracts and enterprise project settlement income is relatively poor. The overall efficiency of construction enterprises is not good, only 18.3% of the company's feedback has increased or reduced losses compared with the same period last year. 2. The sub-index that fell below the threshold of 100% of the boom has increased. Among the eight sub-indices, except for the comprehensive business index, labor index, and input index, they are all below the threshold of 100. The comprehensive business index was 103.0, down 5.7 points. (1) The macroeconomic experience index and the market index fell the most. The macroeconomic experience index in the fourth quarter was 96.7, which was a large drop in the sub-index, down 7.2 points. From the survey details, the surveyed companies are not optimistic about macroeconomic expectations, especially for the industrial, transportation postal warehousing, real estate and information transmission computer service software industry; the surveyed enterprises are in the industry, especially the transportation postal warehousing The industry, the real estate industry, and the information transmission computer service software industry are not confident enough. Enterprises in the wholesale and retail industry and the accommodation and catering industry are more confident in the operation of the industry. In the fourth quarter, the market index was 96.4, which was the largest drop in the sub-index, down 7.8 points. According to a survey of eight sub-industries, 74% of the company's product orders, 73% of the company's total production, and 75% of the company's product sales decreased or remained the same as the same period of the previous year. Among export-oriented enterprises, 71% of foreign companies' orders were reduced or flat compared with the same period of the previous year. In general, it is necessary to boost the expectations of enterprises on the macro economy and the market. (2) The downward trend of cost and capital index continued to slow down and even improved. The cost index in the fourth quarter was 80.5, which was the only increase among the eight sub-indices, with an increase of 11.3 points. From the perspective of the sub-sectors, the cost index of the wholesale and retail industry and the information transmission computer service software industry continued to decline, indicating that the cost pressure of enterprises is still increasing. The cost index of other industries has risen, and the largest increase is in the real estate industry. According to the survey details, 63% of the purchase price of raw materials and energy of the enterprise increased compared with the same period of the previous year, which was 10 percentage points lower than that of the previous quarter; 75% of the enterprise labor cost increased, which was 3 percentage points lower than the previous quarter. In general, the state's policy measures to regulate prices are conducive to the decline of corporate costs, and the cost pressure has been alleviated to some extent. The fund index for the fourth quarter was 86.8, which was basically the same as last quarter and only dropped by 0.5 points. From the survey details, the liquidity index was 80.4, down 4.8 points from the previous quarter, and 10% of the surveyed companies reported sufficient liquidity, which was 3 percentage points lower than the previous quarter. The financing index was 72.5, up 2.6 points from the previous quarter. 4% of the surveyed companies were easy to provide financing, which was slightly higher than the previous quarter. The state has fine-tuned its financing policies and strived to improve the flexibility, pertinence, and forward-looking policies of the policies. (3) The company's efficiency is still poor The benefit index in the fourth quarter was 77.2, which was larger than that of the previous quarter, down 4.1 points. In terms of sub-sectors, the largest decline in the benefit index was in the real estate industry and the information transmission computer service software industry, which fell by 9.2 and 9.8 points respectively. Only the wholesale and retail industry and the construction industry benefit index rose by 2.9 and 1.3 points respectively. According to the survey, 48% of enterprises increased their losses or reduced their profits, an increase of 3 percentage points from the previous quarter. (4) The highest input index The investment index for the fourth quarter was 107.0, which was the highest among the eight sub-indices, down 2.3 points. From the industry point of view, the five major industries of accommodation and catering, social services, industry, wholesale and retail, transportation and postal warehousing are above the threshold of the economy. Compared with the previous quarter, the construction industry, wholesale and retail trade and transportation postal warehousing industry The input index has risen to varying degrees. In the survey's detailed items, industrial enterprises' investment in science and technology innovation has increased, and investment in fixed assets has declined. The company's investment in upgrading and technological innovation is focused on the future development, showing that it is optimistic about the future. (5) The labor force index is higher but the decline is larger. The labor force index in the fourth quarter was 105.3 points, a decrease of 6.3 points, a large decline. From the survey details, the labor demand is relatively strong. Except for the real estate industry, the other seven sub-industry indices are above 100, of which the industrial, social service, accommodation and catering industry and information transmission computer service software industry is up to 115 points; Insufficient labor supply, except for transportation postal warehousing, real estate, wholesale and retail, several other sub-sectors are below 100 points, of which accommodation and catering industry is only 71.7 points. The shortage of labor supply is especially for skilled workers. The highest supply index for skilled workers is no more than 90 points, and the transportation postal warehousing and accommodation catering industry is only 64.7 points and 65.7 points. The supply of college graduates is quite abundant. Except for the accommodation and catering industry, which is 98.6 points, the others are above 113 points, and the real estate industry and wholesale and retail industry are as high as 137.6 points and 133.3 points. 3. The central and western indices continued to be higher than the eastern fourth quarter. The eastern, central and western indices were 90.3, 97.2, and 103.5, respectively, down 4.8, 2.3, and 0.8 points from the previous quarter. From the regional index, the western region is better than the central region, and the central region is better than the eastern region. There are problems with the time lag and the hysteresis effect of macroeconomic regulation. Enterprises' expectations for the future are very important. From the macroeconomic perception index in the sub-indices, the declines in the eastern, central and western regions were 5.1, 11.5 and 12.8 respectively. For the future economic development, the confidence of the eastern enterprises began to increase. Industry is an important part of the real economy. From the perspective of industries in different industries, the declines in the eastern, central and western regions are 1.7, 7.6, and 1.6 points respectively. The enterprises in the central region have lower expectations for the future industrial climate than the eastern region. It will be further passed to the west. According to the survey, the real estate industry will continue to decline in the first quarter of 2012, and the decline will increase, which will further affect the construction industry. At the same time, the market index will continue to decline, and the SME development index will rebound. Not big. In the new year, issues such as the difficulty of financing in the development of small and medium-sized enterprises, rapid increase in production costs, increasing operational pressures, heavy tax burdens, and increased resource and environmental constraints should focus on small and micro enterprises. We will adopt various policy measures to boost corporate confidence and work hard to solve problems. Prevent local problems of small and medium-sized enterprises from becoming a global problem, and the problem of emergence becomes a trend problem, affecting the overall situation of China's social stability and economic development.

(4) The lowest construction industry index for the construction industry index was 88.3. Although it rose by 1.9 points, it was the lowest among the eight sub-industry indices. Judging from the details of the survey, the number of newly signed engineering contracts and enterprise project settlement income is relatively poor. The overall efficiency of construction enterprises is not good, only 18.3% of the company's feedback has increased or reduced losses compared with the same period last year. 2. The sub-index that fell below the threshold of 100% of the boom has increased. Among the eight sub-indices, except for the comprehensive business index, labor index, and input index, they are all below the threshold of 100. The comprehensive business index was 103.0, down 5.7 points. (1) The macroeconomic experience index and the market index fell the most. The macroeconomic experience index in the fourth quarter was 96.7, which was a large drop in the sub-index, down 7.2 points. From the survey details, the surveyed companies are not optimistic about macroeconomic expectations, especially for the industrial, transportation postal warehousing, real estate and information transmission computer service software industry; the surveyed enterprises are in the industry, especially the transportation postal warehousing The industry, the real estate industry, and the information transmission computer service software industry are not confident enough. Enterprises in the wholesale and retail industry and the accommodation and catering industry are more confident in the operation of the industry. In the fourth quarter, the market index was 96.4, which was the largest drop in the sub-index, down 7.8 points. According to a survey of eight sub-industries, 74% of the company's product orders, 73% of the company's total production, and 75% of the company's product sales decreased or remained the same as the same period of the previous year. Among export-oriented enterprises, 71% of foreign companies' orders were reduced or flat compared with the same period of the previous year. In general, it is necessary to boost the expectations of enterprises on the macro economy and the market. (2) The downward trend of cost and capital index continued to slow down and even improved. The cost index in the fourth quarter was 80.5, which was the only increase among the eight sub-indices, with an increase of 11.3 points. From the perspective of the sub-sectors, the cost index of the wholesale and retail industry and the information transmission computer service software industry continued to decline, indicating that the cost pressure of enterprises is still increasing. The cost index of other industries has risen, and the largest increase is in the real estate industry. According to the survey details, 63% of the purchase price of raw materials and energy of the enterprise increased compared with the same period of the previous year, which was 10 percentage points lower than that of the previous quarter; 75% of the enterprise labor cost increased, which was 3 percentage points lower than the previous quarter. In general, the state's policy measures to regulate prices are conducive to the decline of corporate costs, and the cost pressure has been alleviated to some extent. The fund index for the fourth quarter was 86.8, which was basically the same as last quarter and only dropped by 0.5 points. From the survey details, the liquidity index was 80.4, down 4.8 points from the previous quarter, and 10% of the surveyed companies reported sufficient liquidity, which was 3 percentage points lower than the previous quarter. The financing index was 72.5, up 2.6 points from the previous quarter. 4% of the surveyed companies were easy to provide financing, which was slightly higher than the previous quarter. The state has fine-tuned its financing policies and strived to improve the flexibility, pertinence, and forward-looking policies of the policies. (3) The company's efficiency is still poor The benefit index in the fourth quarter was 77.2, which was larger than that of the previous quarter, down 4.1 points. In terms of sub-sectors, the largest decline in the benefit index was in the real estate industry and the information transmission computer service software industry, which fell by 9.2 and 9.8 points respectively. Only the wholesale and retail industry and the construction industry benefit index rose by 2.9 and 1.3 points respectively. According to the survey, 48% of enterprises increased their losses or reduced their profits, an increase of 3 percentage points from the previous quarter. (4) The highest input index The investment index for the fourth quarter was 107.0, which was the highest among the eight sub-indices, down 2.3 points. From the industry point of view, the five major industries of accommodation and catering, social services, industry, wholesale and retail, transportation and postal warehousing are above the threshold of the economy. Compared with the previous quarter, the construction industry, wholesale and retail trade and transportation postal warehousing industry The input index has risen to varying degrees. In the survey's detailed items, industrial enterprises' investment in science and technology innovation has increased, and investment in fixed assets has declined. The company's investment in upgrading and technological innovation is focused on the future development, showing that it is optimistic about the future. (5) The labor force index is higher but the decline is larger. The labor force index in the fourth quarter was 105.3 points, a decrease of 6.3 points, a large decline. From the survey details, the labor demand is relatively strong. Except for the real estate industry, the other seven sub-industry indices are above 100, of which the industrial, social service, accommodation and catering industry and information transmission computer service software industry is up to 115 points; Insufficient labor supply, except for transportation postal warehousing, real estate, wholesale and retail, several other sub-sectors are below 100 points, of which accommodation and catering industry is only 71.7 points. The shortage of labor supply is especially for skilled workers. The highest supply index for skilled workers is no more than 90 points, and the transportation postal warehousing and accommodation catering industry is only 64.7 points and 65.7 points. The supply of college graduates is quite abundant. Except for the accommodation and catering industry, which is 98.6 points, the others are above 113 points, and the real estate industry and wholesale and retail industry are as high as 137.6 points and 133.3 points. 3. The central and western indices continued to be higher than the eastern fourth quarter. The eastern, central and western indices were 90.3, 97.2, and 103.5, respectively, down 4.8, 2.3, and 0.8 points from the previous quarter. From the regional index, the western region is better than the central region, and the central region is better than the eastern region. There are problems with the time lag and the hysteresis effect of macroeconomic regulation. Enterprises' expectations for the future are very important. From the macroeconomic perception index in the sub-indices, the declines in the eastern, central and western regions were 5.1, 11.5 and 12.8 respectively. For the future economic development, the confidence of the eastern enterprises began to increase. Industry is an important part of the real economy. From the perspective of industries in different industries, the declines in the eastern, central and western regions are 1.7, 7.6, and 1.6 points respectively. The enterprises in the central region have lower expectations for the future industrial climate than the eastern region. It will be further passed to the west. According to the survey, the real estate industry will continue to decline in the first quarter of 2012, and the decline will increase, which will further affect the construction industry. At the same time, the market index will continue to decline, and the SME development index will rebound. Not big. In the new year, issues such as the difficulty of financing in the development of small and medium-sized enterprises, rapid increase in production costs, increasing operational pressures, heavy tax burdens, and increased resource and environmental constraints should focus on small and micro enterprises. We will adopt various policy measures to boost corporate confidence and work hard to solve problems. Prevent local problems of small and medium-sized enterprises from becoming a global problem, and the problem of emergence becomes a trend problem, affecting the overall situation of China's social stability and economic development.Double Screwdriver Bit,Double Ended Screwdriver,Security Screwdriver Set,Double End Screwdriver Bit

henan horn tools co.,ltd. , https://www.horn-tool.com